A New Kind of Wealth: Gen Z Is Rewriting the Rules

For years, monetary success complied with a familiar pattern: make progressively, save strongly, purchase a home, and plan for retired life. But Gen Z is approaching money with a fresh viewpoint. As opposed to focusing solely on long-lasting buildup, this generation is focusing on balance, wellness, and deliberate living.

This change has actually given rise to the idea of soft saving. It's not regarding deserting economic objectives but redefining them. Gen Z wants to live well today while still being mindful of tomorrow. In a world that really feels significantly uncertain, they are choosing fulfillment currently rather than postponing happiness for decades.

What Soft Saving Really Means

Soft saving is an attitude that values emotional wellness alongside monetary duty. It shows a growing belief that money must sustain a life that really feels purposeful in the here and now, not just in the distant future. Instead of putting every additional buck right into interest-bearing accounts or retirement funds, many young adults are picking to invest in experience, self-care, and personal advancement.

The increase of this philosophy was sped up by the global occasions of current years. The pandemic, economic instability, and transforming job dynamics triggered several to reconsider what really matters. Faced with changability, Gen Z started to embrace the concept that life ought to be delighted in along the way, not following reaching a financial savings objective.

Psychological Awareness in Financial Decision-Making

Gen Z is approaching cash with emotional recognition. They want their economic options to straighten with their values, psychological health, and way of living goals. As opposed to obsessing over conventional standards of wealth, they are seeking objective in how they make, invest, and save.

This may resemble spending on psychological wellness resources, funding creative side projects, or prioritizing flexible living arrangements. These options are not impulsive. Rather, they reflect a mindful initiative to craft a life that sustains joy and security in a way that feels authentic.

Minimalism, Experiences, and the Joy of Enough

Lots of youngsters are averting from consumerism for minimalism. For them, success is not concerning owning much more however about having sufficient. This connections directly into soft financial savings. Rather than determining riches by product belongings, they are concentrating on what brings genuine happiness.

Experiences such as traveling, concerts, and time with good friends are taking precedence over deluxe products. The shift shows a deeper need to live totally as opposed to gather constantly. They still save, but they do it with intention and equilibrium. Conserving belongs to the plan, not the whole emphasis.

Digital Tools and Financial Empowerment

Innovation has played a significant function in shaping how Gen Z connects with cash. From budgeting apps to financial investment platforms, digital devices make it much easier than ever to remain notified and take control of individual financial resources.

Social network and online neighborhoods also affect exactly how financial concerns are set. Seeing others construct versatile, passion-driven careers has urged lots of to look for similar way of livings. The availability of financial info has actually equipped this generation to develop techniques that benefit them rather than complying with a traditional course.

This raised control and understanding are leading several to look for trusted specialists. Because of this, there has actually been a growing rate of interest in services like wealth advisors in Tampa who recognize both the technical side of money and the emotional inspirations behind each decision.

Security Through Flexibility

For previous generations, financial security typically meant adhering to one job, acquiring a home, and following a dealt with plan. Today, security is being redefined. Gen Z sees flexibility as a type of protection. They value the capacity to adapt, pivot, and check out numerous earnings site web streams.

This redefinition includes how they seek economic guidance. Numerous want approaches that think about job changes, gig work, innovative goals, and changing household characteristics. As opposed to cookie-cutter recommendations, they desire tailored support that fits a dynamic way of living.

Experts that supply insight right into both preparation and flexibility are becoming increasingly valuable. Services like financial planning in Tampa are evolving to include not only typical investment suggestions but also techniques for keeping economic health during transitions.

Realigning Priorities for a Balanced Life

The soft cost savings pattern highlights a vital change. Gen Z isn't ignoring the future, but they're choosing to reside in a way that doesn't compromise happiness today. They are looking for a middle path where short-term enjoyment and long-term stability coexist.

They are still investing in retirement, paying off financial debt, and structure financial savings. Nonetheless, they are additionally including pastimes, travel, downtime, and rest. Their variation of success is more comprehensive. It's not almost total assets however about living a life that really feels abundant in every sense of the word.

This viewpoint is motivating a wave of modification in the financial solutions industry. Advisors who focus only on numbers are being replaced by those who recognize that values, identification, and emotion play a central duty in monetary decisions. It's why extra individuals are turning to asset management in Tampa that takes a holistic, lifestyle-based approach to wealth.

The new criterion for economic health blends method with empathy. It listens to what people in fact desire out of life and develops a plan that supports that vision.

Adhere to the blog site for more insights that mirror the real world, contemporary money habits, and just how to expand in ways that really feel both sensible and individual. There's more to discover, and this is just the beginning.

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Michael Jordan Then & Now!

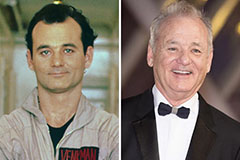

Michael Jordan Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!